2024 Insights on Dairy and Milk Powder Prices + Exports and Trade Flows

Global dairy prices are influenced by the trade of processed products such as butter and skimmed milk powder, with factors such as limited trade share, dominant exporters, and restrictive trade policies contributing to market volatility.

| Table of Contents |

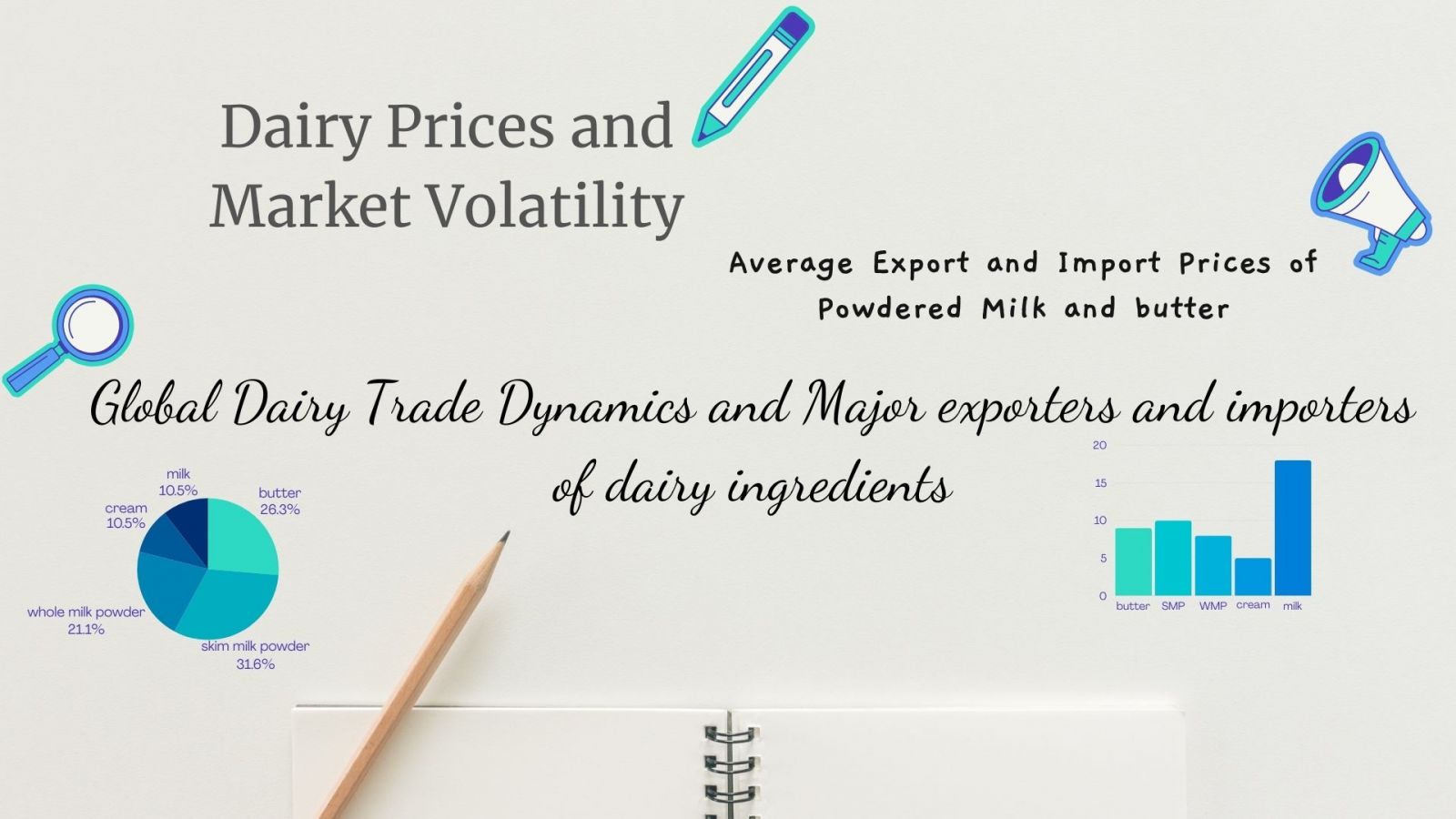

| 1. Global Dairy Prices and Market Volatility |

| 2. Average Export and Import Prices of Powdered Milk and butter |

| 3. Global Dairy Trade Dynamics and Major exporters and importers of dairy ingredients |

| 4. World price of butter in January 2024 |

| 5. World price of WMP in January 2024 |

| 6. World price of SMP in January 2024 |

| 7. Conclusion |

| 8. FAQ's |

The global dairy industry is a dynamic and complex market, influenced by a multitude of factors that contribute to price fluctuations and market volatility. International dairy prices, specifically those of processed dairy products from major exporters in Oceania and Europe, play a pivotal role in shaping the dynamics of the global dairy trade.

Global Dairy Prices and Market Volatility

International dairy prices specifically refer to the prices of processed dairy products from major exporters in Oceania and Europe. Unprocessed milk is not typically included in these prices as it is not commonly traded. Butter and skimmed milk powder (SMP) are the two primary reference prices for dairy, with butter representing milk fat and SMP standing for other milk solids. Together, milk fat and other milk solids constitute approximately 13% of the weight of milk, with the majority being water.

The notable volatility seen in international dairy prices can be attributed to several factors, including the limited trade share (roughly 7% of world milk production), the dominance of a few exporters and importers, and a restrictive trade policy environment. Most domestic markets are only loosely linked to these prices as fresh dairy products are prominent in consumption, and only a small portion of milk is processed compared to what is fermented or pasteurized.

Since 2015, there has been a significant increase in the price of butter compared to SMP. This spike is influenced by heightened demand for milk fat and the European Union’s SMP intervention from initial purchases in 2015 to final disposal in 2019, which led to a price gap between the two products. While the demand for milk fat, particularly for butter, is expected to continue supporting its price on the international market, world demand for SMP is anticipated to surpass demand for milk fat, resulting in the narrowing of the price gap between the two commodities over the forecast period.

The impact of the COVID-19 pandemic on the dairy sector was relatively modest, contrary to initial concerns that the sector was particularly vulnerable. The pandemic primarily affected world butter prices due to reduced demand for milk fat from the hospitality sector. In 2020, butter prices experienced the most pronounced decline, while the price of whole milk powder (WMP) decreased to a lesser extent, and prices for SMP and cheese increased.

Average Export and Import Prices of Powdered Milk and butter

In 2022, the average export price of powdered milk in Iran (Irani Milk Powder) experienced an 18.5% decrease, amounting to approximately $2,340 per ton, while the average import price remained stable at $3,257 per ton.

Moving on to 2024, the price of a 25 kg bag of skim milk powder in Iran ranged from $55 to $62. Chaltafarm being a major exporter of skim powdered milk (non fat dry milk) to countries such as Afghanistan, Oman, Qatar, Iraq, Syria, United Arab Emirates, and Azerbaijan. In various countries including Syria, Oman, Armenia, Tajikistan, Iraq, Turkey, Sri Lanka, Malaysia, and the United Arab Emirates, the import price for one ton of skim milk powder was approximately $2,400.

Additionally, the price of a 25 kg bag of whole milk powder in Iran in 2024 ranged from $75 to $85. Chaltafarm being a major exporter of whole powdered milk (full fat dry milk) to countries such as Afghanistan, Oman, Qatar, Iraq, Syria, United Arab Emirates, and Azerbaijan. In the previously mentioned countries, the import price for one ton of whole milk powder was about $3,200.

Furthermore, the export price for one ton of 82% fat butter in Iran totaled $4,500 in 2024, with Chaltafarm being a major exporter of butter to countries such as Russia, Oman, Qatar, Iraq, Syria, United Arab Emirates, and Azerbaijan.

Global Dairy Trade Dynamics and Major exporters and importers of dairy ingredients

Around 7% of the world’s milk production is traded internationally, primarily due to the perishable nature of milk and its high water content, exceeding 85%. Noteworthy exceptions include small amounts of fermented milk products traded between neighboring dairy-producing nations and liquid milk imports by China. Chinese imports of liquid milk, primarily supplied by the European Union and New Zealand, have notably increased in recent years. Ultra-High Temperature milk and cream products facilitate long-distance shipping of liquid milk, coupled with favorable Chinese freight rates.

China’s net imports of fresh dairy products are expected to increase by 1.5% annually, while the trade share of whole milk powder (WMP) and skimmed milk powder (SMP) exceeds 50% of world production, primarily used as a means to store and trade milk over longer periods or distances.

During the base period, the European Union, New Zealand, and the United States were the three major exporters of dairy products, projected to jointly account for a significant portion of cheese, WMP, butter, and SMP exports in 2030. Additionally, Australia and Argentina are notable exporters, with Belarus emerging as a significant exporter to the Russian market.

The European Union is expected to maintain its position as the world’s leading cheese exporter, with New Zealand remaining the primary source for butter and WMP. China is projected to remain the principal importer of WMP, largely from Oceania. Domestic milk production growth in China is anticipated to limit the increase in WMP imports from New Zealand, which is expected to diversify and slightly increase its cheese production over the outlook period.

Imports of dairy products are dispersed across various regions, with the Near East and North Africa, developed countries, South East Asia, and China serving as dominant destinations. China is poised to maintain its status as the world’s major dairy importer, particularly for WMP, with most imports originating from Oceania, while the European Union has increased its exports of butter and SMP to China in recent years.

As mentioned. milk is traded internationally mainly in the form of processed dairy products. The People’s China is expected to remain the most important importer of milk products, despite a slight increase in domestic milk production relative to the past decade. Japan, South East Asia, Russia, Mexico, the Near East, and North Africa will continue to be other important net importers of dairy products. Compared with rest of the world, per capita consumption of dairy products is low in Asia, especially in South-East Asia. However, economic and population growth, and a shift towards higher-value foods and livestock products are expected to continue to drive the projected increase in import demand for dairy products in many Asian countries. International trade agreements (e.g. CPTPP, CETA, and the preferential trade agreement between Japan and the European Union) have specific arrangements for dairy products (e.g. tariff rate quotas) which create opportunities for further trade growth. Dairy trade flows could be substantially altered by changes in the trade policy environment. For example, large amounts of cheese and other dairy products are traded between the European Union and the United Kingdom. Trade between the two regions could be affected by the new relationship, with transportation delays and changing regulations already increasing trade frictions. The United States-Mexico-Canada Agreement (USMCA) is expected to influence dairy trade flows in North America, with the United States gaining increased access to Canadian and Mexican dairy markets. Though they currently account for a relatively small share of trade, some South American countries like Argentina and Chile could have the potential to become competitors in the global dairy market for WMP and SMP respectively. To date, the big milk consuming countries, India and Pakistan, are largely self-sufficient and have not integrated into the international market. Greater engagement in trade by these two countries could have a significant effect on world markets.

These figures provide a glimpse into the current economic pulse of the dairy market, setting the stage for a comprehensive exploration of the factors driving these fluctuations and their implications on international trade dynamics.

World price of butter in January 2024

The average global price of butter on January 2, 2024 has reached 5514 dollars/ton with an increase of 1% compared to the price of two weeks ago.

.png)

World price of WMP in January 2024

The average global price of WMP on January 2, 2024 has reached 3290 dollars/ton with an increase of 2.5% compared to the price of two weeks ago.

.png)

World price of SMP in January 2024

The average global price of SMP on January 2, 2024 has reached 2613 dollars/ton with an decrease of 0.2% compared to the price of two weeks ago.

.png)

Conclusion

In summary, the global dairy market is a dynamic landscape shaped by various factors, and understanding these complexities is crucial for stakeholders navigating the challenges and opportunities within the industry.

FAQ's

What is the range of prices for a 25 kg bag of skim milk powder in Iran in 2024?

In 2024, the price of a 25 kg bag of skim milk powder in Iran ranged from $55 to $62. Chaltafarm is a major exporter of skim powdered milk (non-fat dry milk) to countries such as Afghanistan, Pakistan, Oman, Qatar, Iraq, Syria, United Arab Emirates, and Azerbaijan.

What are the import prices for Iraq skim milk powder in 2024?

In Iraq, the import price for one ton of skim milk powder was approximately $2,400.

How much is a 25 kg bag of whole milk powder in Iran priced at in 2024?

In 2024, the price of a 25 kg bag of whole milk powder in Iran ranged from $75 to $85. Chaltafarm is a major exporter of whole powdered milk (full-fat dry milk) to countries such as Afghanistan, Pakistan, Oman, Qatar, Iraq, Syria, United Arab Emirates, and Azerbaijan.

What are the import prices for Afghanistan whole milk powder in 2024?

In Afghanistan, the import price for one ton of whole milk powder is about $3,200.

What are the import prices for butter in Qatar, United Arab Emirates, Uzbekistan, and Iraq in 2024?

In the previously mentioned countries (Qatar, United Arab Emirates, Uzbekistan, and Iraq), the import price for one ton of butter is about $4,500.

What is the export price for one ton of 82% fat butter from Iran in 2024?

The export price for one ton of 82% fat butter in Iran totaled $4,400 in 2024. Chaltafarm is a major exporter of butter to countries such as Russia, Oman, Qatar, Iraq, Syria, United Arab Emirates, and Azerbaijan.

Read More:Navigating Global Dairy and Milk Powder Export Markets

To contact the Chaltafarm Dairy Export Department, please refer to the Contact Us section.

Ref:

[1] www.dairyglobal.net/

[2] www.business-standard.com/

[3] https://research.rabobank.com/

[4] www.interfood.com

[5] CLAL

.svg)

.webp)

.webp)